when does capital gains tax increase

The federal income tax does not tax all capital gains. In addition capital gains may be subject to the net investment income tax of 38 percent when income is above certain amounts.

How Do State And Local Individual Income Taxes Work Tax Policy Center

However since your investments pushed you into a higher bracket your total tax bill would be 6790.

. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Hawaiis capital gains tax rate is 725.

Collectibles such as art coins comics 28. This implies that the taxpayer paid an effective rate of 279 percent on the real gain. Unrecaptured gain under section 1250 for real property applies in certain cases where depreciation was previously reported 25.

Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. As a result he realized a capital gain of 9249 and must pay the 238 percent tax 16 of 2201 on this nominal gain. Taxable part of gain from qualified small business stock sale under section 1202.

A short-term gain is gain on the sale of assets held 1 year or less. However after the 1986 capital gains tax increase capital gains tax revenues continued to increase along the same trend again with a large spike in the 1986 fire-sale year. The long-term capital gains tax rate is typically 0 15 or 20 depending on your tax bracket.

Additionally a section 1250 gain the portion of a. The rates do not stop there. Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said.

The capital gains tax is based on that profit. Capital Gains Tax Rate. However since there was inflation during this period the real gain was actually only 7879.

Rather gains are taxed in the year an asset is sold regardless of when the gains accrued. The bank said razor-thin majorities in the House and Senate would make a big increase difficult. Thus for households earning more than 1 million the capital gains tax rate would increase from 238 to 434 as of April 28 2021 thus eliminating the opportunity to recognize gain at current rates in advance of the legislation.

A long-term gain is gain on the sale of assets held over one year. The current tax preference for capital gains costs upwards of 15 billion annually. Capital gains revenues did increase two years after the 1981 capital gains and general tax rate cuts as the economy recovered from the 1981-82 recession.

250000 of capital gains on real estate if youre single. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Understanding Capital Gains and the Biden Tax Plan.

Short-term capital gain is taxed at the same tax rate as your wages. That applies to both long- and short-term capital gains. The tax rate on a net capital gain usually depends on income.

The maximum tax rate on a net capital gain is 20 percent but for most taxpayers a zero percent or 15 percent rate will apply. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. You do not have to pay capital gains tax until youve sold.

The bottom 99 on. When including the net investment income tax the top federal rate on capital gains would be 434 percent. Were going to get rid of the loopholes that allow Americans who make more.

In this case you would be paying 2790 on earnings of 15000 or 186 percent in taxes. To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it.

There are special rules that apply for gifts of property. This means that the first 9875 is taxed at 10 percent and the remainder in this case 25125 is taxed at 12 percent. There is currently a bill that if passed would increase the.

The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. For single tax filers you can benefit from the zero percent.

Capital gains tax rates on most assets held for a year or less correspond to. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. The IRS typically allows you to exclude up to.

To equalize the tax treatment of gains and other income the inclusion rate for capital gains on shares of small businesses should rise to 90 from the. 500000 of capital gains on real estate if youre married and filing jointly. Long-term capital gains are taxed at reduced rates generally 0 15 and 20.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

What Is A Step Up In Basis Cost Basis Of Inherited Assets

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains On Inherited Property

Tax Advantages For Donor Advised Funds Nptrust

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

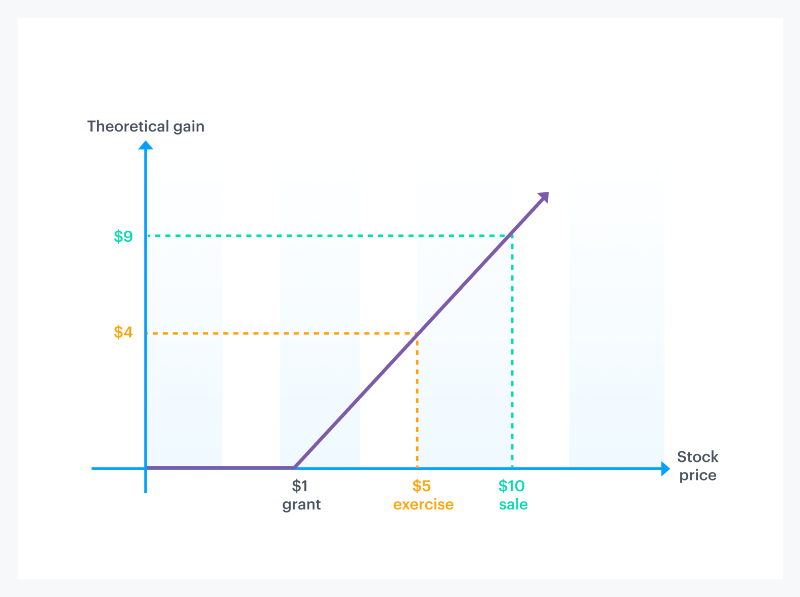

How Stock Options Are Taxed Carta

Difference Between Income Tax And Capital Gains Tax Difference Between

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Can Capital Gains Push Me Into A Higher Tax Bracket

A Big Mistake Joe Biden Wants To Hike Capital Gains Taxes Capital Gains Tax Germany And Italy Capital Gain

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)