tax abatement definition accounting

77 Tax Abatement Disclosures that will require those state and local. The savings in that case results from the difference in the taxability or valuation of.

A real estate tax abatement may reduce a homes property taxes for a period of time or may grant tax breaks to businesses.

. The development is eligible for a 10-year. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm. Legal enforceability is not an essential feature.

Tax abatement programs reduce or eliminate the amount of property tax owners pay on new construction rehabilitation andor major improvements. Applied to property tax savings resulting in practice when a local authority leases a project to a company. A reduction in the amount of tax that a business would normally have to pay in a particular situation for example to encourage investment.

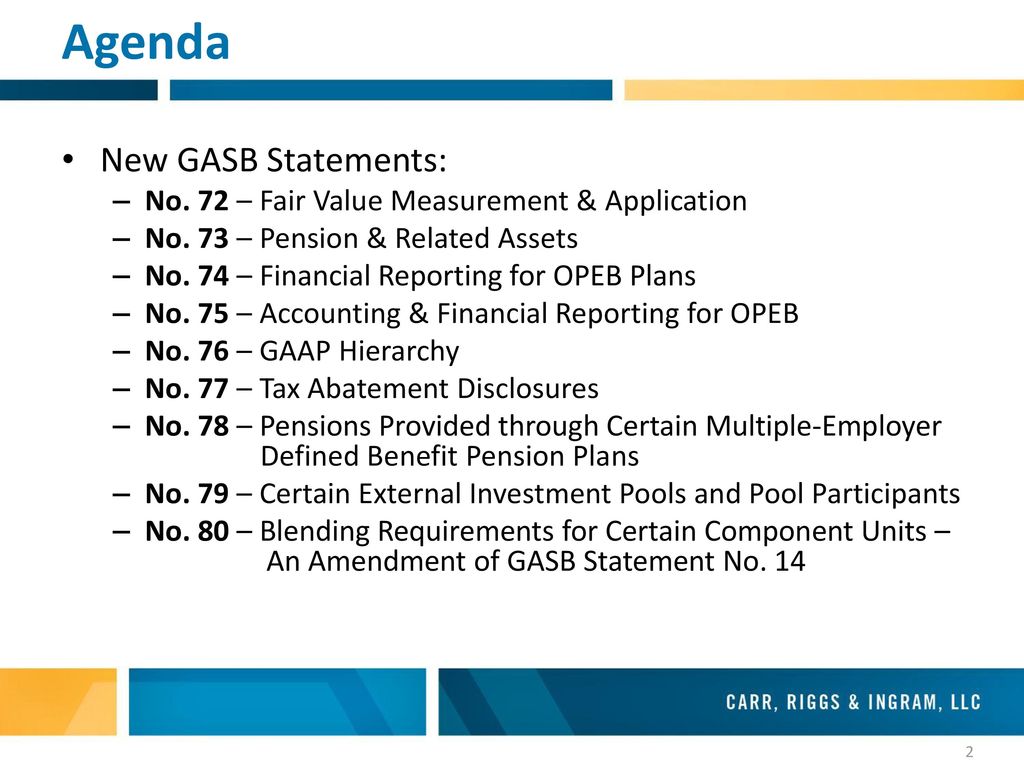

Recently the GASB published GASB Statement No. This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the. A reduction of taxes for a certain period or in exchange for conducting a certain task.

In broad terms an abatement is any reduction of an individual or corporations tax liability. Tax Abatement means the reduction of the amount of property taxes required to be paid on taxable property for a set period of time usually up to 10 years in order to incentivize. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

For accounting and financial reporting purposes a tax abatement is an agreement whereby a government agrees to forgo tax revenues to which it is otherwise entitled in exchange for a. A timing provision separates tax abatements. Tax abatements along with exemptions and deductions are a subset of tax expenditures.

View Abatement definition AccountingToolspdf from ACCOUNTING 2011-10005 at Harvard University. Tax Abatement A reduction of taxes for a certain period or in exchange for conducting a certain task. Such arrangements are known as tax abatements.

For example if one receives a tax credit for purchasing a house one receives tax abatement. The term commonly refers to tax incentives that attempt to promote investments that. Tax abatement synonyms tax abatement pronunciation tax abatement translation English dictionary definition of tax abatement.

The development is eligible for a 10-year. The term abatement refers to a situation where an economic burden. The most common ad valorem taxes are property taxes levied on.

The term abatement refers to a situation where an economic burden is reduced. 121121 731 PM Abatement definition AccountingTools AccountingTools. A reduction in the amount of tax that a business would normally have to pay in a particular situation for example to encourage investment.

The purpose of an abatement is to encourage.

How Tax Incentives Can Power More Equitable Inclusive Growth

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

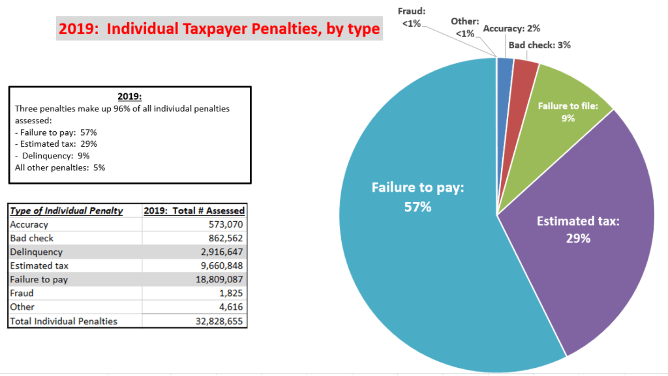

Reasonable Cause To Avoid Tax Penalties

Define Abatement Definition Of Abatement

What Is A Penalty Abatement And How Do I Get One Polston Tax

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

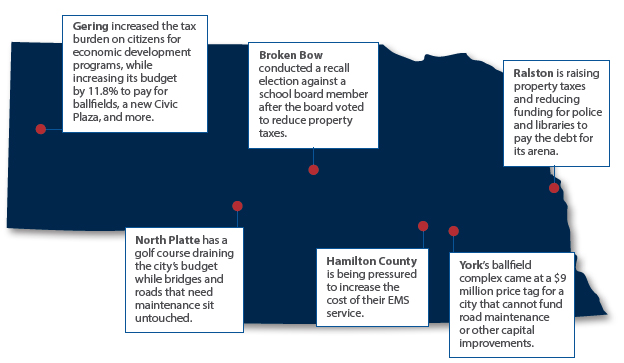

Tax Abatements Under Gasb Statement 77 The Cpa Journal

A Full Breakdown Of Property Tax Exemptions

Top Rated Tax Resolution Firm Tax Help Polston Tax

What Is A Tax Abatement Quickbooks Canada

Gasb Rules Most Tif Spending Will Remain Undisclosed Good Jobs First

Define Abatement Definition Of Abatement

:max_bytes(150000):strip_icc()/GettyImages-1351333930-c16be1d0252a4a798f08cfb753f744fb.jpg)

Taking Advantage Of Property Tax Abatement Programs

Tax Dictionary Irs Penalty Abatement H R Block

What Is The 421g Tax Abatement In Nyc Hauseit

Philly S 10 Year Tax Abatement Philadelphia Home Collective